Home Repairs and Maintenance for New Homeowners

Calling the landlord or apartment superintendent when something needed repair was the norm as a renting tenant, but now that you are a homeowner, there are simple skill sets that do not require a call to your local handyperson! All you need are a few tools and the willingness to learn something new!

Basic tools needed: claw hammer, screwdriver set, adjustable wrench, plunger, drain snake, tape measure, stud finder, plier set, putty knife, and a handsaw. These tools will help you in making simple repairs.

Plumbing Finding your water main shut-off is one of the first things a homeowner should get familiar with. Other water-related things that can be done easily: replacing an O-ring in a leaking faucet, unclogging drains, installing a new showerhead, and repairing a running toilet. The Family Handyman covers other simple jobs that do not need an expensive call to a plumber.

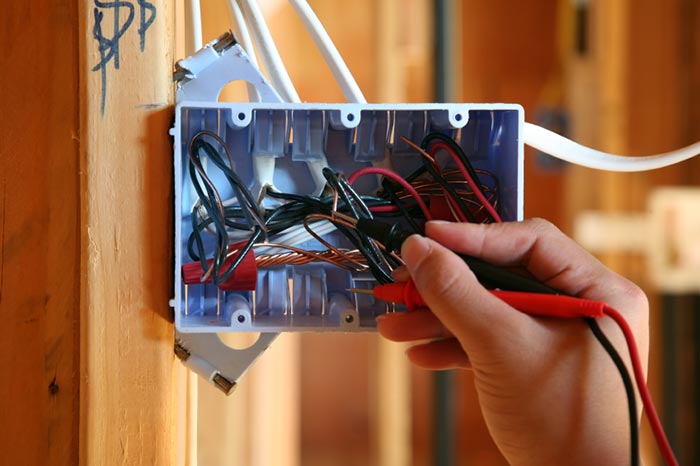

Electricity While an electrician is best for complete rewiring, many homeowners switch out old light fixtures or change them to ceiling fans on their own! Probably the most important thing to know about your new home’s electricity, however, is getting familiar with the circuit breaker box, and knowing how to turn them off or reset them.

Wall Repair Most homes have drywall, and accidents happen, so DIY repairs are a must. Plaster walls can be a bit trickier, but for minor problems, https://www.thisoldhouse.com/walls/21016734/how-to-fix-damaged-plaster

Painting DIY television shows make painting a room look simple, and while that may be, there are more steps to achieving a well-done paint job than using a good quality paint roller.

Home Safety It is imperative to know how to safely use a fire extinguisher as well as how to test smoke and carbon monoxide detectors.

Cleaning the HVAC Unit This simple job can make a big difference in how well your unit runs and it saves money because you are doing it yourself.

Yard Care After years of apartment living, many new homeowners simply do not know how to keep their grass trim or maintain a lawnmower! Bob Vila offers some great mowing tips for a great-looking lawn.

So many small fixes can be handled by you and your family as you learn to take care of your new home! Sure, you are protecting your investment, but knowing you can tackle some of the “small” stuff gives great satisfaction, knowing you are taking care of your family and your home.

Courtesy of New Castle County DE Realtors Tucker Robbins and Carol Arnott Robbins.

Photo credit: karpov construction